UAE Free Zone VS Non Free Zone

We, at Future Focus Infotech, have met many clients who wish to start a business in the UAE. The reasons are incredibly lucrative in nature and the profits, once the business takes off, are abundant. We do not need to tell the client this bit. All this is thought through when the decision to start the business takes place. What our clients lack is the intricate details of starting a business. Which is fair. That is what we are here for, and we do know the UAE like our backyard.

Company formation in the UAE

The Middle East has diversified its economy to attract and welcome international business. Countries such as Dubai has enhanced telecommunications, transport and other infrastructure to facilitate the same.

New Companies can choose to operate from a Free Zone or a Non-Free Zone. Knowing the difference between the two can enable you to make the right choice of location. It is vital to have a complete understanding of all your options to make an informed decision on how to establish your company’s presence in the UAE. The overall growth of the company is directly impacted by this choice. The main difference lies in the requirements to set up a business entity, and the restrictions of the business activities allowed

Points to be taken into consideration while starting a company in the UAE.

- The nature of the business

- The capital investment

- The requirement for investors now or in the future

- Expansion plans now or in the future

- The tax implications

- The legal requirements as per the law of the land

Free trade Zone, also known as Free Zone

Free trade zones are areas in the United Arab Emirates (UAE) that have a special tax, customs and imports regime. These zones work under their own regulations. There are several UAE free zones across Dubai, Abu Dhabi, Sharjah, Fujairah, Ajman, Ras al Khaimah and Umm Al Quwain.

New companies today may opt to conduct their activities from a Free Zone. This is a designated and self-regulated area that is set up to catalyse economic activity within an emirate. This is governed by its own set of rules and regulations. There are approximately 40 Free Zones in the UAE and more coming up.

Each Free Zone has its own governing authority; therefore the requirements vary from Free Zone to Free Zone. However, most of them follow a similar framework. There are two types of companies that can be established in the Free Zone. They are

- Sole Establishment (FZE) with one shareholder

- Free Zone Company (FZC) where there are two or more shareholders.

Both individual and corporate shareholders are allowed. A manager is appointed and is responsible for the day-to-day activities, operations concerning the bank account and is the authorized signatory of the company. The condition is that this manager must be either a UAE resident or is in the process for applying for residency.

Benefits of a Free Zone

- 100% foreign ownership (there is no need for a local sponsor or partner)

- 100% repatriation of profits and capital

- 100% personal, dividend, and corporate income tax redemption

- Exemption from import and export duties

- No currency restrictions

- Vast scope of activities are licensable

- Effective and efficient communications (modern and up-to-date)

- Fantastic support service

- Can operate 24 hours a day

Limitations of registrations within a Free-zone

- Not allowed to trade directly with the UAE Market

- Can trade within UAE only via Locally appointed distributors

- 5% Customs Duty applicable to the local business

- Employees are permitted to work strictly from the office within that specific Free-zone

- Documents must be completed only in English or Arabic Language

- Must possess a valid lease for office/warehouse space and/or development land

Non-Free Zone

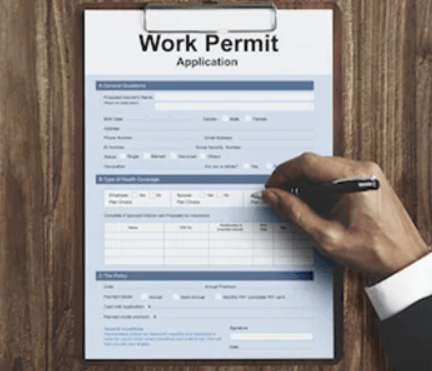

Companies not registered in a Free Zone (a local Department of Economic Development Mainland License) will require a local sponsor. A maximum of 49% foreign ownership is allowed.

Benefits of a Non-Free Zone

- Allows you to operate freely in any location of the UAE

- A non-free zone license does not restrict you to any one location.

Limitations

- The process of obtaining the license is strict concerning legalities and documentation

- The documents have to be signed by the local sponsor as well

While the basics are quite easy to grasp, the application is a whole different ball game. Do give us a call when you want to decide the best options for your business. We are the partners you need to provide you with the best-laid plans for your proposed business activity. We are here with you all the way. Be it to find a local sponsor, the required paperwork and the apt location for your business.