Germany Expat Payroll and Tax Benefits

If your company has deployed resources to Germany or if you are planning to in the near future; then this is what you have been looking for. Sending in your resources to Germany is quite a feat. Germany is considered to be one of the world’s most rewarding environments when it comes to overseas businesses. You can take the word of over 22,000 expats who have settled down in the country. Don’t forget, they employ more than 2.8 million resources.

Once you have figured out the Germany Employment visa requirements, the next step is the need to be aware of the intricate details with respect to expat payroll and tax benefits of Germany.

Payroll

Processing payroll is a very critical function of any organization. It necessitates an understanding of the current regulations, in-depth tax knowledge to ensure proper payment, withholding and filing, and a highly systematic system that can be relied upon to pay each resource the right amount of money. Read here to know more about payroll processing.

Payroll in Germany

As a company ready to deploy your resources to Germany, be aware of what your overseas peer owes you. Paperwork processing is crucial to accurate compensation.

Preparatory payroll

Note that the employers must provide your resources with payslips. This document contains data pertaining to total earnings in the specific pay period, tax deductions, and social security contributions such as insurance and pension.

All payroll data is prepared by the middle of the previous month. New employees are created and reported to both the tax office and the health insurance. A contribution is signed. The files of existing employees are checked regularly for changes. The marital status of the employee, for instance, affects the tax code as well as the insurance contribution. Therefore, in order to ensure preparation of payroll, all data regarding the employee must be available and accurate.

Payroll execution

Payroll is now created every month based on the information about the resource. The ratio of the gross versus net wages will vary depending on the marital status of the employee, current tax code and the data recorded in the contract. The number of leaves taken, and the purpose of leave is vital to the payroll as well. For instance, if the resource is on parental leave, the reduction in the wages will be made accordingly. Paygrade also plays a role in the amount transferred to insurance.

Delivery of payroll

Once the payroll accounting is documented, the employers in Germany have to send the receipt. These receipts are known as payslips and can be delivered either by post, or online.

Electronic bank transfers are the prefered mode of payment to employees and third parties. This is under the country’s standard File Transfer and Access Management (FTAM) protocol. Once approval is given, the banks are authorized to release the payments and other specified contributions.

Points to be taken into account regarding payroll accounting in Germany

- The employee data should be up-to-date

- The compensation must be carefully categorized based on wages or salary

- Number of leaves taken

- Number of national public holidays

- Amount of deductions by the employer on behalf of the employee

Income tax in Germany

In Germany, income tax is known as Einkommensteuer. Income taxes are paid throughout the year in the form of ‘wage tax’ (Lohnsteuer). In most circumstances, if you live in Germany continuously for more than 6 months you must file a tax declaration (Steuererklärung) with your local tax office (Finanzamt).

Income tax in Germany is progressive: first, income tax rates start at 14%, then they rise incrementally to 42%; last, very high income levels are taxed at 45%. The top tax rate of 42% applies to taxable income above €55,961. Finally, for taxable income above €265,327, a 45% tax is applicable.

The tax year in Germany is the calendar year. You can file a tax declaration on your own or seek professional tax advice. As of 2019, people who declare their tax via the electronic tax declaration system (Elektronische Steuererklärung, ELSTER, see below) have until 31 July. In certain circumstances, such as if you are ill or if documents are missing, you can ask for an extension of the deadline to 30 September. If you choose to take professional tax advice, you have until 31 March the following year. There may be penalties if your tax declaration is filed late.

By submitting your income tax declaration (Einkommensteuererklärung) to the tax office, you will find out if you have made over-payments and are entitled to a refund.

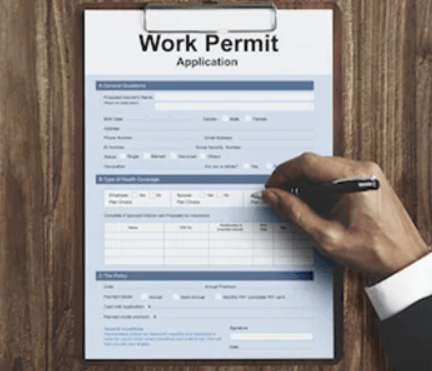

Tax identification number

All individual residents in Germany receive a tax identification number (Steueridentifikationsnummer) to ensure their unique identification within the tax system.

A tax ID is an 11-digit number that is required to process your income tax. It must be included on all applications, declarations and communications you submit to the German tax authorities.

You do not have to submit a separate application for a tax ID as a foreigner. You will receive your tax ID automatically by post between two-to-four weeks after you register your address.

Role of employers

Proper income tax collection is crucial to executing payroll in Germany. As a rule, it is the employer’s responsibility to calculate the income tax amount for each employee based on his or her specific tax class and supply the withheld amount to authorities.

Tax for expats

Expatriates living in Germany are subject to German taxes, especially if they have German source income. The tax structure is similar to other western countries. Tax is paid throughout the year with the employer making appropriate deductions from each paycheck. Adjustments are made annually in case of overpayment or underpayment.

Avoid double tax

Make a note of the income earned before becoming a German resident. Determine the rate on your taxable income in Germany if you transfer to work within the calendar year.

Germany has entered into tax treaties with various other countries to prevent expats from paying taxes both in their home country as well as in Germany. This helps establish which country your taxes must be paid in and which income may be exempt from tax in Germany.

Payment of tax

Employers deduct income tax from your gross wage and transfer it to the tax office on your behalf. Your pension, health, nursing care and unemployment insurance are also deducted from your gross wage and transferred by your employer.

All German medium and high earners are obligated to pay income tax. The German Church Tax on the other hand is optional. There is a way to opt out of it. Understand the various social deductions that can be made out of your salary as well. Public health insurance for expats could prove to be expensive.

Future Focus Infotech

Future Focus Infotech, a 25+ year specialist in IT Human Capital Augmentation services, with operations spanning 15 locations, with an extensive partner network to leverage local strength to deliver global scale.

Give us a call and take care of all your payroll requirements and tax benefits. Focus your energies on growing global partnerships while we take care of your employees’ needs abroad.