Payroll Requirements and Benefits for Expats in Bahrain

If your business has employees, payroll will be a part of the deal. There is no way to avoid it. The question is, what are the elements?

It can mean any or all of the following

It can refer to the employees being paid, along with their respective information It can refer to the amount being paid to the employees during the pay period It can refer to the process of calculating and distributing the wages and taxes

Bahrain has always been a great place to expand and for various reasons. What can be worrisome is the laws of the land and the ability to keep up with them. When deploying resources to Bahrain, keep an eye on especially the payroll requirements and benefits for expats who choose to settle down there. While most companies prefer to outsource the tedious process to an agency to ensure complete compliance, it is prudent to be aware of the basics, nevertheless.

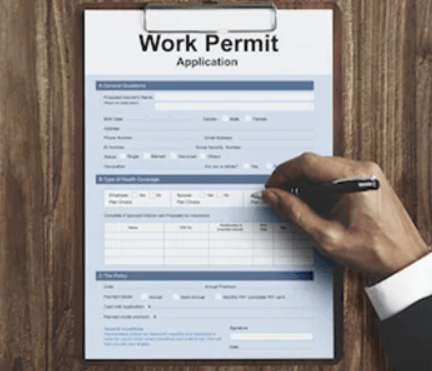

Tax Haven

No personal tax. No capital gains tax. No withholding tax. All expats would bear minor deductions from the monthly salary. The current rate of contributions to the SIO is 19% for local employees (12% employer; 7% employee) and 4% for expatriate employees (3% employer; 1% employee). These contributions to the SIO are to be withheld by the employer and remitted to SIO on a monthly basis. The VAT is being introduced as we speak.

End of contract payment

Another quantifiable benefit of being an expat in Bahrain is the sizeable end-of-contract payment that they are entitled to at the end of the assignment. This amount varies depending on the duration of their time in Bahrain. Bahrain has signed bilateral agreements with various countries to work with them. The aim is to avoid double taxation. Connect with us to know more about this list.

Health is wealth

Most expats are covered by the organisation that they are working for. More often than not, they are covered by their individual policies taken before relocating to Bahrain. Nevertheless, Bahrain offers excellent medical facilities. This includes highly qualified doctors who can speak englsh.

Positive work culture

Having expats from all over the world, Bahrainians are very welcoming in nature. They help expats settle down and fit in with ease.

Job security and personal satisfaction

Expats are never uneasy about their career and profession in Bahrain. Specialised skills are respected and valued highly.

English is the universal language

Unlike many other countries where it is important to learn languages like Arabic and Urdu, English is a language that would suffice for any kind of communication. This is a big benefit for expats who have settled down in Bahrain.

Diversity and integration

Bahrain is one of the few countries that has no religious or political disputes. Both expats and locals enjoy the freedom of religion without any conditions and threats. The unity in diversity is truly celebrated in Bahrain.

Small country, small population, accessible accommodation

The size of the country and population is small. Finding accommodation close to the workplace is not a struggle for expats. This brings a lot of relief to those who move into the country without any known faces. Children of expats have plenty of options for schooling.

Transport

Unlike most countries where the lack of private transportation renders one helpless, Bahrain’s bus and taxi service enables the must needed independence in expats.

Equality between men and women

2002 saw a big leap in the rights of women. This ensured that female expats were also treated with equal respect and courtesy.

Bahrain is ranked second in the world when it comes to a survey for the best destinations for expats and international professionals. This is according to the survey taken from 22,000 expats in 163 countries worldwide. The survey included factors such as career development, work-life balance, accommodation, culture, etc. It also included additional relocation packages and medical benefits.

While living as an expat has its many advantages, crucial care is key. In order to ensure a successful relocation of your employees in the land of opportunities, ensure that you partner with Future Focus Infotech. We bring you the experience and expertise of this land. With the support of our local partners, we ensure sufficient care and attention with respect to payroll and various other policies and procedures that have to be adhered to.