Payroll and Everything you should know about it

Processing payroll is a very critical function of any organization. It necessitates an understanding of the current regulations, in-depth tax knowledge to ensure proper payment, withholding and filing, and a highly systematic system that can be relied upon to pay each resource the right amount of money.

What is payroll processing?

Payroll processing refers to the task of managing the payment of salaries and wages by an organization to its employees. The steps involved in payroll processing include gathering employee time information for a selected time, managing the benefits and deductions, and distributing employee pay for that time. It consists of the tracking of hours worked, the calculation of employee’s salary, and the distribution of payments via direct deposit directly to their account or by check.

Why does payroll matter?

Payroll is a significant expense for most companies. It is the primary component of labour cost. Labor costs will vary not just by industry, but by geography as well. Organizations that deploy employees overseas for assignments or who have establishments and branches across borders must keep in mind the laws of the land during payroll.

Why is it essential to have accurate records in payroll?

HR must maintain accurate payroll records. Since HR can help retain valued employees, it is in the best interest of the organization that they are paid what is due. It is also a vital step in legal compliance.

How does it work?

Calculating payroll can be a complicated process. It involves ensuring that every employee – part-time, full time or freelance/contract – is paid accurately based on the proposed terms and conditions. It includes deductions of tax and other miscellaneous items such as insurance as well.

In the accounting world, calculating the payroll is a vital yet thankless job. The calculations must be accurate, and the paychecks must be printed on time. Old, new and departing employees must be added to or deleted from various processes. Their respective taxes must be remitted to the proper authorities on time and in the right amount.

Benefits of payroll

At the heart of any successful business are your employees. They are not like other expenses. They are the ones that enable you to gain a competitive edge in the market. They connect with the one-off customers and convert them into repeat business and grow your brand.

By ensuring that your employees get paid on time, you make them feel secure and valued. It enhances their level of engagement with the work that they do. By improving employee satisfaction and decreasing turn over, the level of service towards your customer is higher.

The benefits to the organization are also substantial. A lot of effort is put into understanding the business trends and related expenses. It is vital to utilize these analytics and past incidents to make data-driven decisions in the present and future. Payroll is essential because it can be used to enhance business processes for better outcomes.

Collaborating performance data with payroll data is another neat way to understand the resources and their productivity. Spikes in overtime, for instance, can explain staffing shortage or lower productivity. By understanding the exact reason for staffing shortages, the issues can be worked out for better future outcomes. This could be decreased over time and increased retention.

Payroll is also a critical element of finalizing the budget. It can be used to determine the correlation between funds spent on resources and the outcome. By integrating payroll data with other data, the Human Resources Information System can work on receiving the best return.

Elements of payroll

Timekeeping

Time and attendance are critical to payroll. Whether employees are salaried or paid by the hour, time and attendance tracking help ensure that they are being compensated for the right amount and the correct work executed. It helps cover the organization from a legal standpoint.

Calculating the payroll

The hourly employee’s gross pay is the product of the hourly wage and number of hours worked. Salaried employees are being paid the total gross pay per pay period. The total salary received by the employee is the gross pay minus tax and any other deductions, as it may apply.

Deductions and compensations

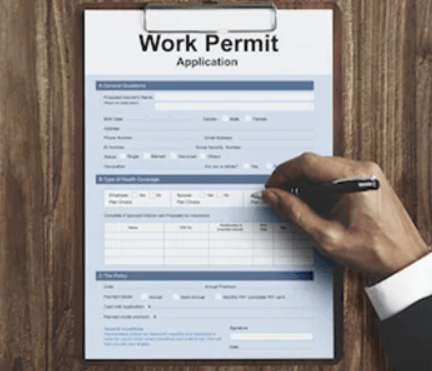

The payroll deductions are subject to various clauses, such as the country in which they are working, the employee provident fund and taxes, health insurance, charitable contributions, etc.

Processing payroll

Payroll is processed continuously. It is a recurring activity and must be executed with precision and on time. Manual processing may be inexpensive, but it is arduous and prone to error. Outsourcing is another option, and it helps reduce time and error. The third option is to purchase payroll software.

Common Issues that Leave Employers Subject to Penalties

If you are found non-compliant with the formalities of payroll, the following are the common infractions

- Late payment of payroll taxes

- Incorrect claims of exemptions

- Non-declaration of fringe benefits

- False or erroneous declaration of employees as part-time or contractors

- Non-compliance with the laws of the land in which the employees are deployed

Why do most companies prefer to outsource payroll?

As long as the organization exists, the payroll will happen. The cycle is such that as soon as the process ends, it begins again. Many companies outsource some of the work not just to avoid dedicating talented resources towards mundane calculations, but to ensure dedicated expertise towards the same.

For many organizations, using payroll systems or outsourcing payroll can help to mitigate stress and minimize errors. Outsourcing payroll allows employers and business owners to concentrate on their core business. It frees up the decision making staff, human resources or accounting personnel to work more on strategic tasks that could ultimately affect your bottom line.

Benefits of outsourcing payroll

- Dedicated experts towards payroll and HR

- Accurate forecasting

- Saves time, money and resources

- Cost-effective

- Safe backup

Future Focus Infotech seamless secondment services include handling all the legal and financial processes from visa applications to invoicing & payroll, involved in the overseas deployment. Future Focus Infotech is the perfect solution to your HR and staffing hassles. It works as a regional partner to assist your company in processing visa documents and obtaining necessary approval from specific countries where projects are undertaken. The services include HR, Payroll, logistics, accommodation and everything else that an employee may need during overseas deployment.

Future Focus Infotech is a digital offering from Future Focus Infotech (FFI), a 20+ year specialist in IT Human Capital Augmentation services, with operations spanning 15 locations, with an extensive partner network to leverage local strength to deliver global scale.

Give us a call and take care of all your payroll requirements. Focus your energies on growing global partnerships while we take care of your employees’ needs abroad.