Legal Requirements for Payroll in UAE

A rapidly growing economy has made regions such as the UAE to realise the importance of welcoming foreign nationals. Global companies have also been exploring various opportunities here by pursuing projects and establishing franchises. Destination Middle East is the call for the day. There are six Gulf Cooperation Council states Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates (UAE).

The benefits are immense.

- Tax-free salaries

- High Quality of life

- Multi-cultural workforce

- Plenty of work opportunities

- Work packages with benefits such as insurance and 30 days of vacation per annum

- Strategic location geographically

- Trade free zones

Legal Requirements for payroll in UAE

UAE is a federation comprising of seven regions and more than nine million people. The free market economy welcomes foreign investments and creates employment opportunities thereby enabling the growth in the countries. Doing business here has become more comfortable with infrastructure and 100% foreign ownership possibilities.

What we as expats need to know are the legal requirements for payroll here. Navigation through the regulations is incredibly labour intensive. Regular amendments in the conditions can cause quite a hassle to the companies, non-compliance of which can cause serious consequences. Incorporating UAE regulations into global payroll strategy is key to organizational success.

There are specific rules concerning payroll and taxation in the UAE. This depends on whether your company employs foreign nationals or locals. UAE pays additional attention to the locals, and this is an excellent way to ensure that there is a balance the employment ratio.

There are little corporate tax concerns in the UAE with no social security for expats, no payroll tax, and no statutory pension contributions for expats.

The incorporation

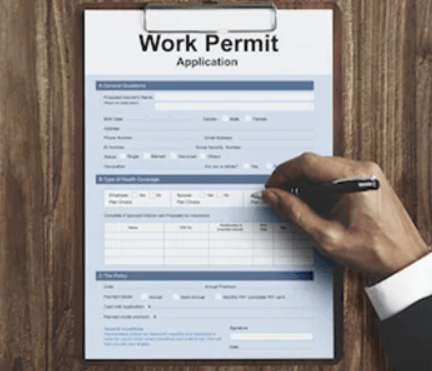

Incorporation of business will involve various processes, the approval timelines of which will depend on the type of entity. While a body in the free-zone can ordinarily be incorporated within two to three weeks, registration outside a free-zone can take up to three months. A formal entity is established to process the UAE payroll. All formalities are ideally completed during the establishment of the body.

Employment law

UAE Employment law applies to both foreign and national workers. The newly hired have to sign off on a Federal Labour Contract that is registered with the Ministry of Labour. This must be done in time for the application of the visa for the foreign employees.

Working Hours

The domain of the organization ideally dictates the standard work week and the working hours. It also depends on the education and title of the employee. The public sector, for instance, works from Sunday to Thursday. Private businesses set their schedules based on the shifts. An 8-hour working day with a 48 hour maximum per week is the ordinary work week.

Compensation

While education dictates the minimum wage, the payment transfer must be processed through UAE’s electronic salary transfer system known as the Wages Protection System (WPS). Probation period stands at a maximum of 6 months.

Compensation is paid for overtime (when working hours exceed 48 hours per week). Working on Friday ( day of rest) entitles the employee to a substitute day of rest or an overtime pay of time and a half. Women are not required to work night shifts.

Termination

Termination warrants for mandatory pay. Exceptions include quitting without adequate notice and termination for a cause such as violation of company policy. Completion of one year or more entitles the employee to twenty-one days of severance pay towards each of the first five years in service along with thirty days of payment for every additional year.

To enter the UAE, it makes good sense to be aware of the legal compliances in the region. Ignorance is not an excuse. Hiring a Global Employment Organization will enhance your ability to achieve success and stay updated on all the critical guidelines with respect to the payroll.